2018/19 Federal Budget Highlights

Federal Treasurer Scott Morrison delivered his third budget this week, with a focus on further strengthening the economy to “guarantee the essentials Australians rely on” and “responsibly repair the budget”.

With a deficit of $18.2b in 2017/18 and $14.5b in 2018/19, the Budget is forecast to return to a balance of $2.2b in 2019/20 and a projected surplus of $11b in 2020/21.

The government is proposing a three-step, seven-year plan to make personal income tax “lower, fairer and simpler”. Additionally, the Budget contains a range of measures intended to ensure the integrity of the tax and superannuation system.

The full Budget papers are available at www.budget.gov.au and the Treasury ministers’ media releases are available at ministers.treasury.gov.au. Highlights of relevance to our clients include:

For Individuals and Small Business

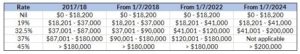

• A seven-year Personal Income Tax Plan will be implemented in three steps, to introduce a low and middle-income tax offset, to provide relief from bracket creep and to remove the 37% personal income tax bracket.

• The Medicare levy low-income thresholds for singles, families, seniors and pensioners will be increased from the 2017/18 income year.

• The $20,000 instant asset write-off will be extended for small businesses by another year to 30 June 2019.

Superannuation

• The maximum number of allowable members in SMSFs and small APRA funds will be increased to six from 1 July 2019.

• The annual audit requirement for self-managed superannuation funds will be changed to a three-yearly requirement for funds with a history of good record keeping and compliance.

• Individuals whose income exceeds $263,157, and have multiple employers, will be able to nominate that their wages from certain employers are not subject to the superannuation guarantee (SG) from 1 July 2018.

• An exemption from the work test for voluntary contributions to superannuation will be introduced from 1 July 2019 for people aged 65-74 with superannuation balances below $300,000, in the first year that they do not meet the work test requirements.

• Insurance arrangements for certain superannuation members will be changed from being a default framework to being offered on an opt-in basis.

Comprehensive analytics and research

We invest a great deal of time and effort researching the best tax effective investment strategies for our clients. We have developed a number of systems to manage and track the marketplace.

The investment landscape always evolves and it is more important than ever to consider your investments and superannuation funds carefully. We pride ourselves on being experts in researching opportunities, investments and strategies that fit in with your retirement goals. We want, our clients to get on with enjoying their life rather than worrying about money.

For an obligation free conversation about your financial future, please contact us on 03 9190 8964 or at advice@endorphinwealth.com.au

Phillip Richards and Robert Rich

Endorphin Wealth Management

Phillip Richards is a qualified Financial Advisor with over ten years’ experience. Contact Phillip today to discuss how you can build your own wealth and plan to reach your retirement goals.

Robert Rich is a qualified Financial Advisor with over nine years of personal investment experience. Contact Robert today to discuss how you can build your own wealth and plan to reach your retirement goals.

This information is general in nature and does not take your personal situation into account.

Contact Us for quality financial advice so you can feel good about your future.