It’s one of the most common questions we’re asked by clients seeking advice on their retirement planning needs. How much Super do I need to retire? It’s a complicated question to answer off the cuff as it depends on several variables. Age, other assets, attitudes towards risk and of course the type of lifestyle you would like to live in retirement can have a role to play.

Always start with the end in mind

As with any goal, to understand the path, we must determine the desired result. Questions like ‘When would you like to retire?’ and ‘What type of lifestyle do you want to live in retirement’ can assist us to define the goal we’re hoping to achieve.

If you’re looking to retire as soon as possible and live a lavish lifestyle will require a much larger balance than average. There is no right or wrong answer to these questions – it all depends on the your dreams and desires for your life in your golden years.

ASFA Retirement Standard

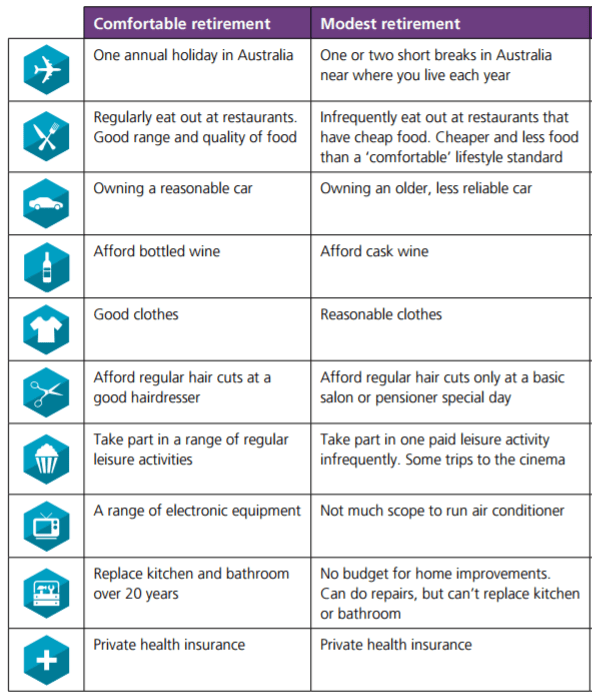

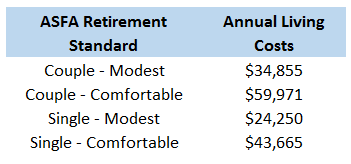

The Association of Superannuation Funds of Australia Ltd (ASFA) created a Retirement Standard aiming to identify an annual budget required needed by the average Australian to fund a comfortable or modest lifestyle in retirement.

Source: ASIC

Both budgets assume that the retirees own their home outright and are relatively healthy. The research differentiates ‘Modest’ and ‘Comfortable’ in the below table:

Source: ASFA

Note that you may be aiming for different definitions in your own retirement and may need to adjust your figure accordingly. We often find that people are looking to increase their expenses in retirement on overseas holidays and spoiling the grandchildren and may need $80,000 – $100,000pa. Another way to estimate your retirement living costs is 75% of your after-tax income before retirement.

The Magic Number

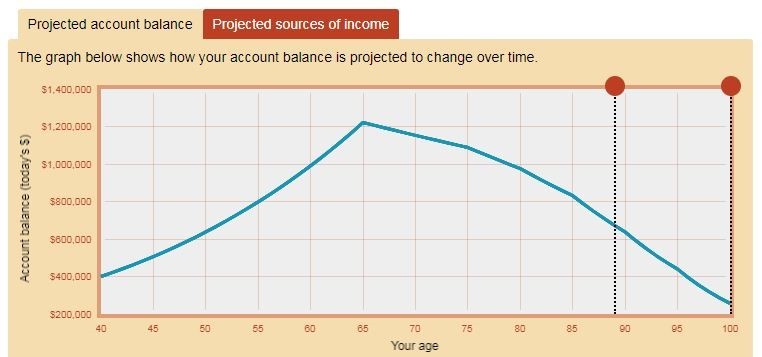

We’re able to combine this number with your estimated life expectancy and projected investment returns to provide a lump sum amount you will need at retirement. This number is of course not set in stone, but will provide you with a target to aim for and a date to achieve it by.

Next Steps

Once you have identified your target amount, the next process in retirement planning is to look at the path to achieving your goal. You should note that your financial situation is likely to change over time and careful consideration should be given to:

+ Projected Income – Are your salaries likely to increase / decrease? Will you be accumulating investment assets to supplement your income?

+ Projected Expenses – Are you expecting to have more children? Do you want to travel more often? Are you considering downsizing your home?

These changes can be modeled with you current cashflows to identify the path to get you to your retirement goal. You may already be on the right path, or we may need to make some adjustments to achieve your goal.

Other Important Considerations

+ Is your Superannuation fund right for you? We pay close attention to not only the investments you are holding within your Super, but also the fees you are paying. More information can be found in our previous blog: https://www.endorphinwealth.com.au/retirement-planning-super/

+ Is Salary Sacrificing a viable option in your situation to build up your Super balance in a tax-effective manner?

+ A thorough review of your current budget and cashflow to determine any surplus.

+ Centrelink and Age Pension implications.

How Endorphin Wealth Management can help

Non aligned

The advice we provide at Endorphin is always in our client’s best interests because we are not licensed by the big financial institutions. We access a range of products from different providers that can be tailored to our client’s needs.

We also utilise subscriptions to three of the top research providers in Australia to cross reference our research and recommendations.

Comprehensive analytics and research

We invest a great deal of time and effort researching the best retirement planning strategies for our clients. We have developed a number of systems to manage and track the marketplace.

The investment landscape always evolves and it is more important than ever to consider your investments and superannuation funds carefully. We pride ourselves on being experts in researching opportunities, investments and strategies that fit in with your retirement goals. We want, our clients to get on with enjoying their life rather than worrying about money.

For an obligation free conversation about your financial future, please contact us on 03 9603 0072 or at advice@endorphinwealth.com.au

Phillip Richards and Robert Rich

Endorphin Wealth Management

Phillip Richards is a qualified Financial Advisor with over ten years’ experience. Contact Phillip today to discuss how you can build your own wealth and plan to reach your retirement goals.

Robert Rich is a qualified Associate Financial Advisor with over nine years of personal investment experience. Contact Robert today to discuss how you can build your own wealth and plan to reach your retirement goals.

This information is general in nature and does not take your personal situation into account.

Contact Us for quality financial advice so you can feel good about your future.